A long-term incentive plan (LTIP) incentivizes employees to take actions that will maximize shareholder value and promote long-term growth for the organization. In a standard LTIP, the employee, who is normally a senior executive, is required to meet a number of criteria to receive the incentive.

This incentive is paid out on top of the executive’s base salary and can often come in the form of a cash incentive. Both private companies and publicly traded firms implement discretionary incentive programs for their employees based on performance metrics.

In this DecuSoft blog, we examine emerging long-term compensation programs and long-term performance policies among the leading U.S. corporations. We go over “best practices” for long-term incentive plans, implementation issues, and compensation committee strategies. We also discuss the mix of long-term vehicles granted, the duration of long-term incentive commitment intervals, the use of relative performance metrics, and an update on shareholder advisory group policy revisions.

There are a few design factors to remember if you’re planning a new incentive plan or modifying an existing incentive plan. Knowing what success metrics can drive specific expectations and habits is essential. Compensation options should be balanced with responsible results and, ideally, you’re reducing risk in the process.

Understanding Long-Term Incentive Plan (LTIP)

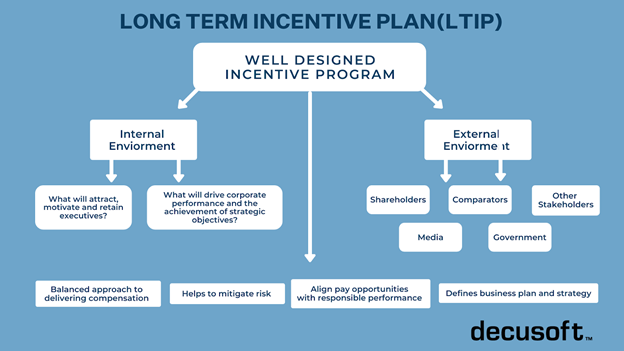

Long-term incentives are earned based on the achievement of goals over a longer period of time. The goals may be based on stock price or business performance. It’s important to take a holistic approach to compensation – if it’s short- or long-term, cash vs. bonds, the kinds of vehicles you’re using, and so forth.

Think about what vehicles would draw, inspire, and retain executives. What strategies would you use to help them drive organizational success and accomplish the organization’s strategic goals?

The External Environment and LTIPs

The external environment plays an important role in determining LTIPs. External factors can continue to influence executive compensation. The media is often focused on executive pay and perceived pay issues or disparities present in publicly traded firms. We need to ask when creating LTIP, how will the press respond? This should definitely be a consideration.

The government plays an important role with the regulations that have been put into place in the past couple of years. An example of one of these regulations is “Say on Pay” or regulations that have been proposed which may or may not come about, like pay for performance rules and others. You know what’s happening in the legal system and what compliance requirements you may be required to follow.

Think in terms of your competitors and other companies. What programs are they implementing? We’re seeing a move towards refining equity plans more focused on pay for performance. This is because shareholders and other investors are focused on these metrics. Knowing what your competitors do is crucial. You want to remain competitive and with other companies in your industry.

Key Takeaway

- External factors such as the press, government regulations, and what your competitors are doing are important considerations when designing a long-term incentive plan.

When Do Workers Earn Long-Term Incentive Plan Benefits?

Many LTIPs last three to five years before achieving the full value of the reward. Individuals can not earn the whole reward at once, depending on the award’s vesting plan. Full-value awards are vest based on time, and the employee needs to stay with the company over a period of time.

These plans have different purposes and objectives. This blog focuses on equity-based awards, which is the most typical type of long-term award in a public company. But there are a small number of firms that use cash, as well. Long-term incentive plans are also an opportunity to provide compensation that’s based on performance, and hopefully provide competitive pay opportunities.

Key Takeaway

- Most long-term incentive plans span a period of three to five years before the employee receives the full value of the reward.

What Are the Various Forms of Long-Term Incentive Plans Available?

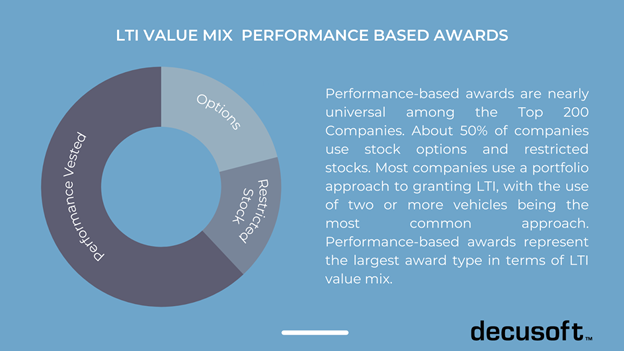

The majority of companies utilize options and performance-based awards as part of their LTI program. Performance-based awards are nearly universal among the Top 200 Companies. About 50% of companies use stock options and restricted stocks. Most companies use a portfolio approach to granting LTI, with the use of two or more vehicles being the most common approach. Performance-based awards represent the largest award type in terms of LTI value mix.

Key Takeaway

- Most companies use restricted stock options and performance-based awards. The Top 200 Companies all use performance-based awards.

Long Term Incentive Types

Appreciation vehicles:

- Stock Options

- Stock Appreciation Rights (SARs)

Time-vested full value vehicles:

- Restricted stock or restricted stock units (RSUS)

Performance-vested vehicles:

- Typically full-value awards: Performance shares or performance share units (PSUs)

- Can also be performance-vested options or performance cash plans (LTIPs)

Stock Options: The right to purchase shares of company stock at a specified price (exercise price) during a specified period of time (term). Stock options, or stock awards, provide good alignment with shareholders and are easy to communicate. They are also a fixed expense.

Stock ownership may not be viewed as performance-based by some as it is not tied explicitly to company financial performance. Stock options present the possibility for dilution; stock-settled SARs are less dilutive than options.

Time vested restricted stock: The grant of shares (or the promise to grant shares in the case of RSUs) contingent on meeting the requisite service period. Time vested restricted sticks have strong retention value and are popular with employees and shareholders. These are less dilutive than traditional stock options, are still easy to communicate, and represent a fixed expense.

Time vested restricted stocks are often criticized and viewed negatively as “pay for pulse” by some. These provide no leverage and are not tied explicitly to company financial performance.

Performance-Vested Shares / PSUs: Shares (or the promise to receive shares in the case of PSUs) contingent upon achieving associated performance goals and meeting the requisite service period. These provide a strong focus on performance and alignment with shareholders. They are also popular with advisory firms.

Performance-Vested Shares are a fixed expense and may be subject to reversal if performance goals are not met. They may be less dilutive than other options. However, there are challenges in setting performance criteria and poor goal setting may lead to a perception that they are less valuable. Reversal of expense is not possible for awards earned based on market conditions (share price/TSR).

Key Takeaway

Types of long-term incentives include appreciation vehicles (stock options and stock appreciation rights), time-vested full value vehicles (restricted stock), and performance-vested vehicles.

Long-Term Incentive Plan Terms

Vesting Period/Schedule: A span of time determined by a corporation that specifies whether an individual can assume full ownership of an asset – usually equity options or retirement funds – is referred to as a vesting plan.

Cliff Vesting: Under this sort of vesting schedule, the individual receives the ability to the whole reward at once, instead of over a period of time.

Gradually Vesting: Continues over time, with a certain proportion of the prize vesting each year. It is not unusual for no percent of the gain to vest for the first five years, with additional years vesting at rising percentages until the commodity is entirely vested.

RSUs (Restricted Stock Units): An RSU is a pledge from an employer to issue a certain amount of shares of the company’s stock at a future date. Since the recipient would not collect the stock until later, this form of reward has no voting rights.

Restricted Equity Awards: Similar to RSUs, except the owner owns the stock and has voting rights right away.

Employee Stock Option (ESO): A grant to a person to purchase a certain amount of securities of a business at a predetermined price at a later date. If the price of the stock is higher than the fixed price at the time that the individual will purchase it, the individual can benefit from purchasing shares at the set price and selling them at the market price. A person does not have to wait until all of their shares have vested before buying stock; instead, after a portion of their shares has vested, they can exercise that portion at any time. It is not in their best interests to exercise the option if the stock price is less than the set price.

Performance-based LTI: PSUs are performance share units. This is when you grant someone the right to receive shares in the future, but their share is contingent upon achieving associated performance goals and meeting the requisite service period. It’s almost like vested restricted stock but with a pretty big caveat. There is a performance condition that has to be something related to company performance.

Performance Metrics: Performance measures should be aligned with business strategy. They should reflect the key drivers of corporate and shareholder value. Performance metrics should create a clear line of sight for key employees that focuses their efforts and maps their accountability.

Absolute Metrics: Absolute metrics rely on the potential to forecast future results and may not be well received by investors.

Relative Metrics: Dependent upon the ability to predict future performance. These may not be viewed positively by shareholders and can serve as “plugs” when absolute performance is difficult to predict. There is the possibility of payouts for negative/poor performance that is merely “less poor” than that of some comparators.

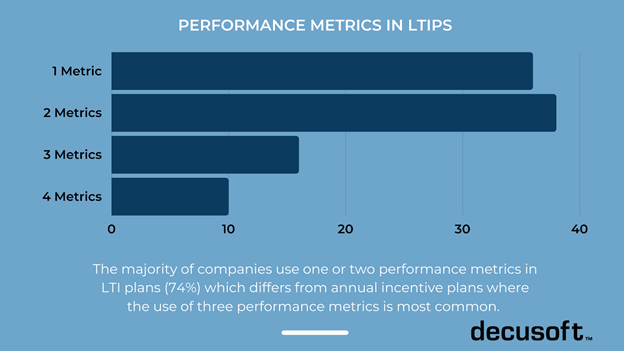

The majority of companies use one or two performance metrics in LTI plans (74%) which differs from annual incentive plans where the use of three performance metrics is most common.

Relative TSR: Relative TSR is one of the most prevalent performance metrics used among LTI programs. Relative performance is useful when absolute performance is difficult to predict. Relative TSR is viewed favorably by shareholders and shareholder advisory firms. These are not directly within management’s control. The “Phoenix effect” can penalize steady performers and selecting the “right” comparator group is critical. The expense is recognized even if the award is not earned.

Key Takeaway

- There are many different types of long-term incentive plans with accompanying metrics including absolute metrics, performance metrics, and relative metrics.

Shareholder Advisory Firms

- ISS Guidelines – ISS Pay for Performance Tests:

- Relative Degree of Alignment (RDA)

- Compares the percentile ranks of a company’s CEO pay and TSR performance, relative to an ISS-developed peer group, over the prior three-year period.

- Multiple of Median (MOM)

- The previous year’s CEO pay is calculated as a multiple of the reference group’s median CEO pay for the most currently available annual period.

- Pay-TSR Alignment (PTA)

- Compares the trends of the CEO’s annual pay and the change in TSR over the prior five-year period.

2018 Update

Financial Performance Assessment (FPA)

Used as a secondary screen; when the traditional 3 screens above result in a “low” concern, may change the result to “medium” concern if financial performance is weak. Conversely, a “medium” concern may change to “low” if financial performance is strong. Analysis compares relative ranking (versus ISS selected peers) of three-year CEO pay to three-year financial performance; metrics and weightings will be industry-specific.

Tax Cuts and Jobs Act of 2017

Early versions of this bill had drastic changes to the treatment of equity and deferred Compensation. These have been removed from both the House and Senate versions House and Senate versions both make major changes to Section 162(m). Performance-based exceptions for compensation paid over $1M would be eliminated. CFO was returned to a group of covered employees. Potential effects include the return of subjective metrics/discretion and potential pushback from shareholders / other groups.

Pitfalls to Avoid

Pay for performance misalignment: The majority of equity awards are not performance-based. Increasing target LTI award in a year of poor corporate or stock price performance. Award payouts in years where TSR has fallen. Dividends on unearned or unvested shares are paid out.

Size/concentration of awards: Large sign-on/retention awards or other one-off awards outside of the annual program. CEO and other proxy officers receive an out-sized portion of grants – measured as a percentage of NEO awards to all employee awards.

Performance Metrics: Discretion usually viewed negatively, seen as “double-dipping” by using the same performance metric for both short term and long term. Single, non-relative metric is likely problematic.

Design parameters: 1-year performance periods in a long term” incentive plan. Large/uncapped upside potential. No ownership guidelines or holding requirements. No clawback policy. Change in Control – Avoid single trigger vesting of equity awards. Significant concern for shareholders and advisory firms.

Key Takeaway

- Make sure to avoid pitfalls including pay for performance misalignment, “double-dipping” performance metrics, and not including a clawback policy.

Key Considerations in Long-Term Incentive Plan Design

- Align with strategy

- Balance is crucial

- Reevaluate on a regular basis

- Understand the ramifications of change

- Assess risk

- Communicate, communicate, communicate

- Don’t simply follow the herd

Feeling overwhelmed? Consider using Compensation Management Software to help manage your comp program. Also check out our guide to compensation management.